maryland student loan tax credit status

The Maryland student loan debt relief tax credit came in effect in July 2017 by the MHEC. We are experts in securing permanent financial protection from the government.

Student Loans May Qualify For Federal Forgiveness

Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt at the time of applying for the tax credit.

. The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt are eligible to apply for the Student Loan Debt Relief Tax Credit. The Renters Tax Credit Program provides property tax credits for renters who meet certain requirements.

You have incurred at least 20000 in total undergraduate andor graduate student loan debt. If the credit is more than the taxes you would otherwise owe you will receive a tax refund for the difference. The concept rests on the reasoning that renters indirectly pay property taxes as.

Larry Hogan said Tuesday. Student Loan Debt Relief Tax Credit. The purpose of the Student Loan Debt Relief Tax Credit is to assist Maryland Tax Payers who have incurred a certain amount of undergraduate or graduate student loan debt by providing a tax credit on their Maryland State income tax return.

The student loan debt relief tax credit program for tax year 2021 is closed student loan debt relief tax credit. For example if you owe 800 in taxes without the credit and then claim a 1000 Student Loan Debt Relief Tax Credit you will get a 200 refund. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for Maryland resident taxpayers who are making eligible undergraduate andor graduate education loan payments on loans from an accredited college or university.

The maximum credit is 5000. Enter the total level of tax credit up to 5000 being claimed based upon the total eligible undergraduate student loan debt balance as of submission of the tax credit application. The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes.

The governor announced in a news release that nearly 9 million in tax credits will be granted to residents who have student loan debt which will be awarded through the Maryland Higher Education Commission. Please note that the full amount of the tax credit will have to be used to pay down. If the credit is more than the taxes you would otherwise owe you will receive a tax refund for the difference.

COMRAD-012 2021 Page 3 NAME SSN PART G - VENISON DONATION - FEED THE HUNGRY ORGANIZATIONS TAX CREDIT 1. From July 1 2021 through September 15 2021. Maryland taxpayers who maintain maryland residency for the 2021 tax year.

The tax credits were divided into. To be considered for the tax credit applicants must complete the. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for Maryland resident taxpayers who are making eligible undergraduate andor graduate education loan payments on loans obtained to earn an undergraduate andor graduate degree ie.

Is there an option to. For example if you owe 800 in taxes without the credit and then claim a 1000 Student Loan Debt Relief Tax Credit you will get a 200 refund. You can claim the Student Loan Debt Relief Tax Credit if you meet the following conditions.

Enter the amount up to 50 per deer of qualified expenses to butcher and process an antlerless deer for human. BALTIMORE AP Applications are being accepted in Maryland for the 2018 Student Loan Debt Relief Tax CreditMaryland Higher Education Commission Secretary James Fielder made the announcement. Complete the Student Loan Debt Relief Tax Credit application.

Student Loan Debt Relief Tax Credit Application. Student Loan Debt Relief Tax Credit Program. Maryland student loan tax credit status.

I received a Maryland student loan debt relief tax credit and I must submit a 502CR along with the certificate for my taxes. Since its launch in 2017 more than 40600 residents have benefited from the Maryland Student Loan Debt Relief Tax Credit Program. The tax credit of up to 5000 can be received by the qualified taxpayers and it also depends on the.

MARYLAND FORM 502CR INCOME TAX CREDITS FOR INDIVIDUALS Attach to your tax return. Will have maintained residency within the state of Maryland for the 2020 tax year Have incurred 20000 or more in student loan debt undergraduate or graduate and Currently owe at. The plan was modeled after and designed to be similar in principle to the Homeowners Tax Credit Program which is known to many as the Circuit Breaker Program.

There were 9155 Maryland residents who were awarded the 2021 Student Loan Debt Relief Tax Credit. From the last three years the state of the United States of America has allocated funds to help out the graduate and undergraduate students to pay their individual student loans. Nearly 9 million was awarded with.

The Student Loan Debt Relief Tax Credit is a program created under 10 -740 of the Tax -General Article of the Annotated Code of Maryland to provide an income tax credit for Maryland resident taxpayers who are making eligible undergraduate andor. You have at least 5000 in outstanding undergraduate student loan debt when you submitted an application for certification to the Maryland Higher Education Commission. BALTIMORE WJZ More than 9000 Marylanders with student loan debt will receive tax credits to put toward their balance Gov.

A copy of the required certification from the Maryland Higher Education Commission must. The Student Loan Debt Relief Tax Credit may be claimed on Form 502CR by certain qualified taxpayers in the amount certified by the Maryland Higher Education Commission.

Filing Maryland State Taxes Things To Know Credit Karma Tax

How I Applied For The Maryland Student Loan Tax Credit Fire Esquire Tax Credits Student Loans Student Debt

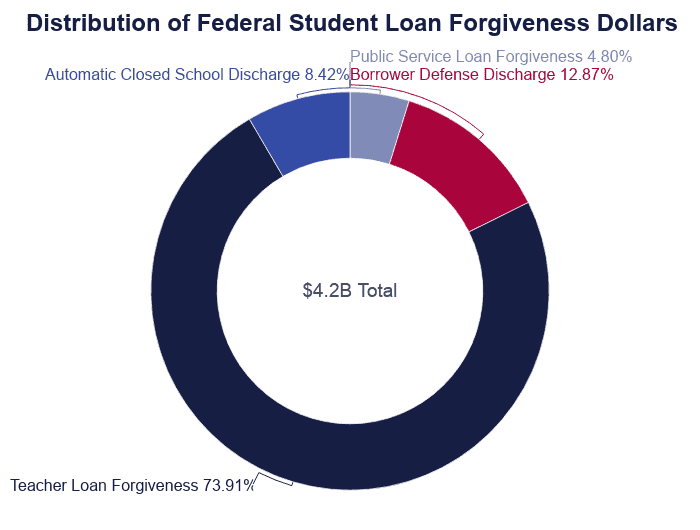

Student Loan Forgiveness Statistics 2022 Pslf Data

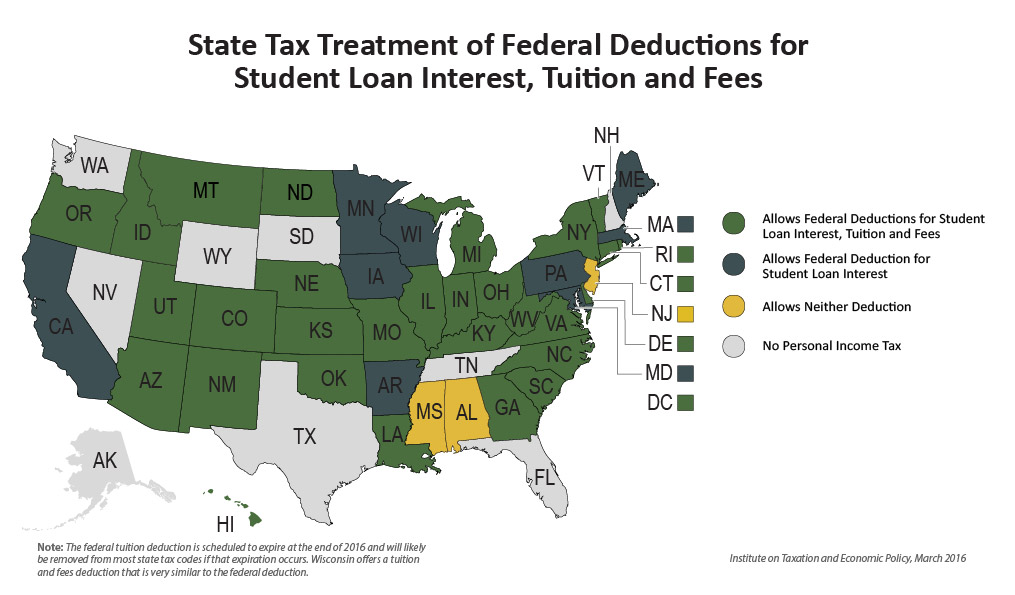

Learn How The Student Loan Interest Deduction Works

Learn How The Student Loan Interest Deduction Works

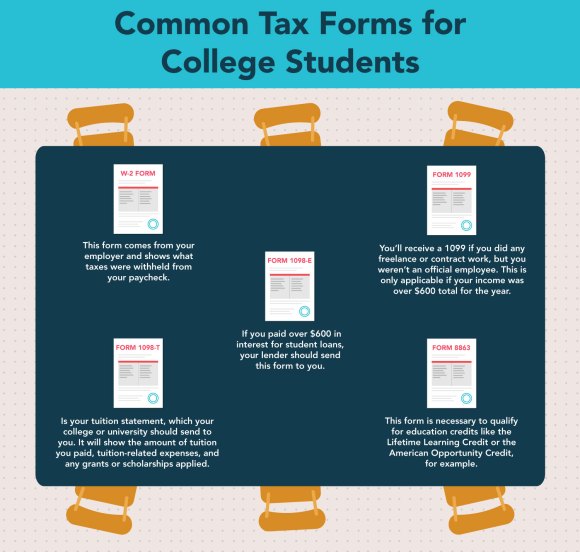

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Can I Get A Student Loan Tax Deduction The Turbotax Blog

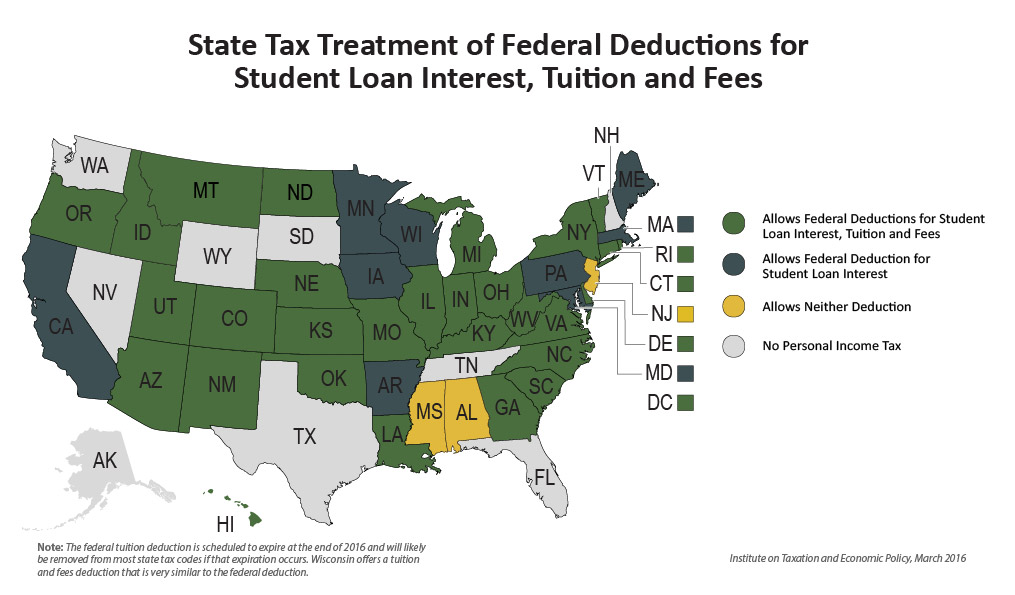

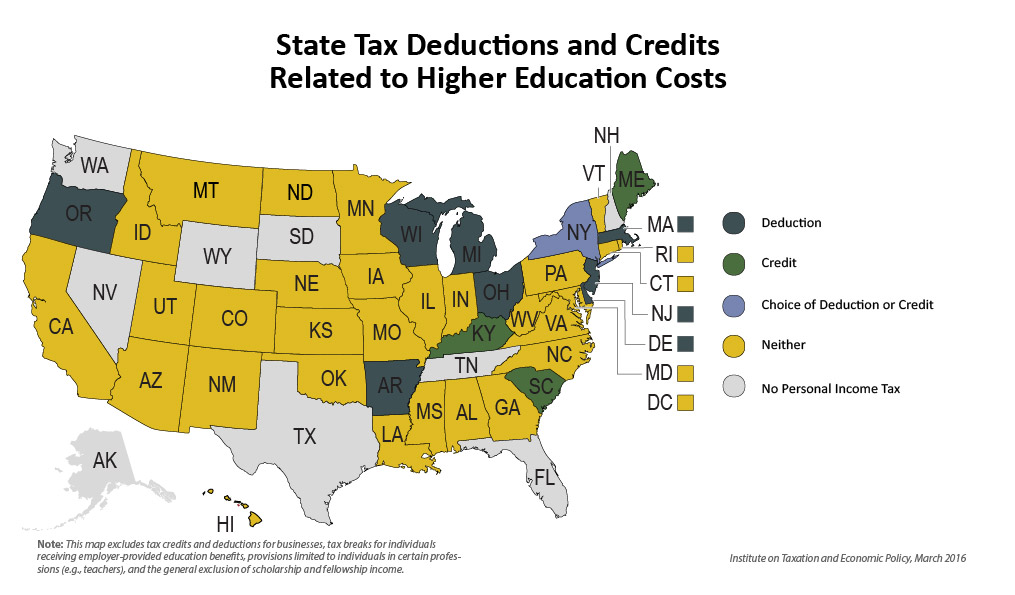

Higher Education Income Tax Deductions And Credits In The States Itep

Maryland Student Loans And Financial Aid Programs

How To Claim The Maryland Student Loan Tax Credit Fire Esquire Student Loans Student Loan Debt Tax Credits

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Maryland Refundwhere S My Refund Maryland H R Block

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Student Financial Aid Allegany College Of Maryland

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Learn How The Student Loan Interest Deduction Works

Higher Education Income Tax Deductions And Credits In The States Itep